Advanced Micro Devices (AMD) has announced impressive growth in its third quarter, with revenue reaching $5.8 billion, up 4% from the previous year and 8% sequentially. This growth can be attributed to the increasing demand for AI chips and data center technology, as well as the introduction of new products. AMD is a key player in the production of processors and graphics processing units (GPUs) used in AI machines.

In the third quarter, PC client revenue recovered, reaching $1.5 billion, a substantial increase of 42% compared to last year. However, gaming revenues experienced a decline of 8% during this period.

“We delivered strong revenue and earnings growth driven by demand for our Ryzen 7000 series PC processors and record server processor sales,” said AMD CEO Lisa Su.

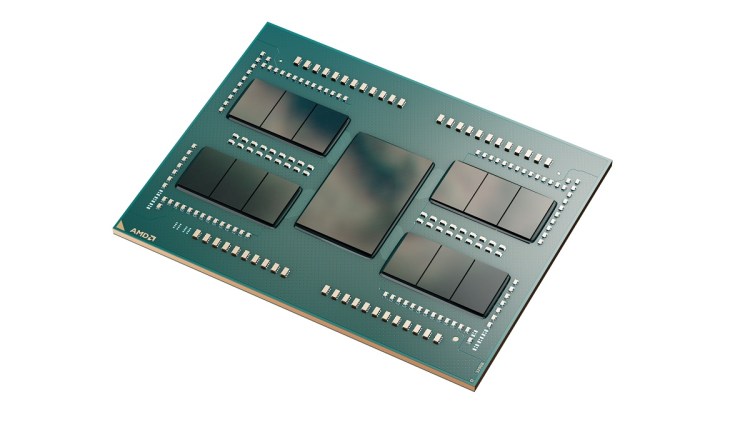

AMD’s data center business has been on a significant growth trajectory, thanks to the strength of their EPYC CPU portfolio and the ramp of Instinct MI300 accelerator shipments. With these developments, AMD expects to support multiple deployments with hyperscale, enterprise, and AI customers.

Despite the positive growth, AMD’s stock experienced a 4.4% drop in after-hours trading, currently valued at $94.11 a share. However, the company’s overall market capitalization is $159 billion, surpassing rival company Intel’s $153 billion.

Market Share Expansion and Outlook

During a call with analysts, Lisa Su expressed her confidence in AMD’s market position. She believes that the company will continue to gain market share in data center chips, and as the PC market returns to normal buying patterns, they will see an increase in market share in that sector as well.

Financial analysts had anticipated Q3 earnings per share to be around 64 cents on revenue of $5.37 billion. However, GAAP net income for the third quarter exceeded expectations, amounting to $299 million, or 18 cents a share, reflecting a 353% increase from the previous year. On a non-GAAP basis, net income amounted to $1.13 billion, or 70 cents a share, up by 4% from last year.

“We executed well in the third quarter, delivering year-over-year growth in revenue, gross margin, and earnings per share,” said AMD CFO Jean Hu.

In the fourth quarter of 2023, AMD projects revenue to be approximately $6.1 billion. This represents a year-over-year growth of approximately 9% and sequential growth of approximately 5%. The company also expects a non-GAAP gross margin of approximately 51.5%.

Segment Performance

AMD achieved significant growth in its client group, with sales reaching $1.5 billion, a 42% increase from the previous year. This growth was primarily driven by higher Ryzen mobile processor sales and an increase in AMD Ryzen 7000 series CPU sales.

In the data center segment, AMD reported flat sales of $1.6 billion compared to last year. Despite the stagnation, sales of 4th Gen AMD Epyc CPUs experienced growth, which offset a decline in adaptive system-on-chip (SoC) data center products.

The embedded segment witnessed a decrease in revenue due to a decline in the communications market, resulting in revenue of $1.2 billion, down 5% year-over-year. Revenue in the gaming segment also experienced a decline of 8% year-over-year, primarily from a decrease in semi-custom revenue.

AMD’s rival company, Intel, reported a decrease in revenue of 8% compared to the previous year. However, the cloud adoption of AMD Epyc processors continues to grow, with major companies like Microsoft Azure, AWS, and Oracle incorporating AMD’s processors into their instances.

To support the growing AI market, AMD completed the acquisition of Nod.ai, an open-source AI software expert. This acquisition enhances AMD’s AI software capabilities and enables accelerated deployment of AI solutions across various AMD products.

With strong financial standing, AMD plans to invest $400 million over the next five years to expand research, development, and engineering operations in India. This investment will result in the addition of approximately 3,000 new engineering roles by the end of 2028.

In conclusion, AMD has reported impressive growth in its third quarter, driven by increased demand for AI chips and data center technology. The company’s strong performance in the PC client and data center segments, as well as their strategic acquisitions, positions them for further success in the market.

- Source: [Original Article](insert link here)