Reviving the Semiconductor Industry

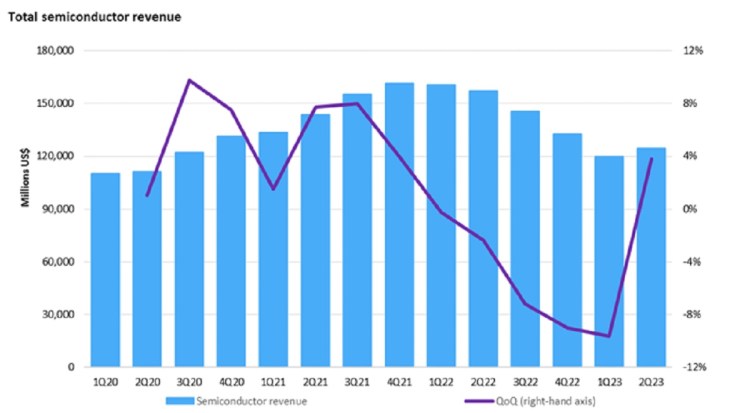

After experiencing five consecutive quarters of declining revenue, the semiconductor industry has made a remarkable turnaround in the second quarter, as revealed in a report by market researcher Omdia.

Positive Growth in Q2

According to Omdia’s Competitive Landscape Tracker, quarterly revenue witnessed a growth of 3.8%, reaching $124.3 billion in Q2. This trend aligns with historical patterns, where second-quarter revenue typically sees an average increase of 3.4% from the first quarter, based on data spanning from 2002 to 2022.

Segment-Specific Divergence

However, it’s worth noting that growth within various semiconductor segments has deviated from historical norms. For instance, the dynamic random access memory (DRAM) market soared by 15% in Q2 2023, compared to the usual 7.5% growth seen in second quarters historically.

Recovery Amidst Market Contraction

Omdia sees this growth as a positive sign for the semiconductor industry following its prolonged period of decline, marking the longest such downturn since the company began tracking the market in 2002. However, despite the recent revival, the semiconductor market’s current revenue stands at 79% of its value from one year ago when it reached $160 billion in Q2 2022. A return to late 2021 revenue levels will take some time.

“Nvidia, a dominant force in the generative AI market, played a pivotal role in the semiconductor industry’s resurgence in Q2 2023.”

The key driver behind the semiconductor industry’s turnaround in Q2 2023 was Nvidia. The sector witnessed a collective increase in revenue of $4.6 billion from the previous quarter, and Nvidia alone contributed $2.5 billion to this quarterly revenue growth. Nvidia’s significant growth can be attributed to the surging demand for generative AI, a market where Nvidia holds a prominent position.

The data processing segment, particularly fueled by AI chips used in servers, experienced an impressive 15% quarter-over-quarter (QoQ) growth and now accounts for nearly one-third of semiconductor revenue (31% in Q2 2023). On the other hand, the wireless segment, primarily driven by smartphones, faced a 3% QoQ decline due to persistent weak end-demand.

Notably, the automotive semiconductor sector continued its growth trajectory, marking a 3.2% increase. Nvidia’s remarkable performance resulted in a significant leap in its semiconductor revenue, rising by 47.5% from the previous quarter. In just one year, Nvidia ascended from being the ninth-largest semiconductor company by revenue to claiming the third position by the end of Q2.

While Nvidia played a pivotal role in this industry-wide resurgence, it’s essential to recognize that most major semiconductor firms contributed to this growth. Among the top ten companies, eight reported an increase in semiconductor revenue in Q2 2023, highlighting that the industry’s turnaround is not confined to a single sector.