Overview

Acadian Ventures, the New York-based early-stage venture capital firm, has successfully raised $30 million for its second venture capital fund. With a focus on technologies for the future of work, Acadian Ventures’ capital commitments for this fund were oversubscribed. The fund has attracted a diverse group of investors, including venture capital firms, family offices, high-net individuals, and contributors from the firm’s first fund.

Investment Strategy

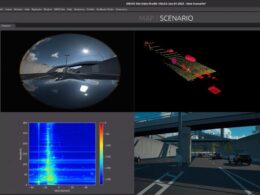

Acadian Ventures Fund II, which is nearly three times the size of its inaugural fund, has already allocated capital to 12 investments. The firm specializes in supporting the next generation of work technologies in four key areas: intelligent work applications powered by artificial intelligence (AI), work infrastructure involving data and APIs, new regulatory and compliance solutions, and the emerging global workforce. These strategic areas are expected to present significant opportunities, enabling innovative ways of managing work, creating new market categories, and disrupting established industry players.

“We are excited to partner with Acadian Ventures to support investment in the next generation of work technologies that are drastically improving the employee experience. The firm’s strategy to focus on maximizing human potential aligns well with our ServiceNow Ventures strategy to foster innovation in companies at the leading edge of digital transformation.” – Philip Kirk, Senior Vice President of Corporate Business Development at ServiceNow

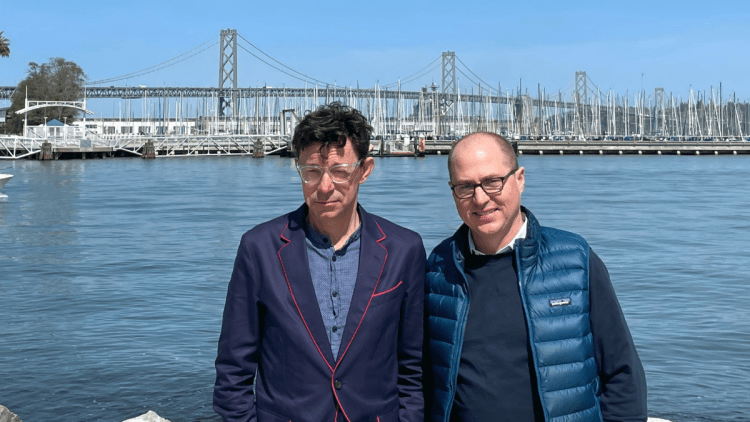

Acadian Ventures’ first fund, known as Acadian Ventures Fund I, is already performing well and ranks as a top decile fund according to research firm Pitchbook. Notable investments from the first fund include Oyster, Nomi Health, SmartRecruiters, and Techwolf. Led by experienced general partners Jason Corsello and Thomas Otter, Acadian Ventures has established a reputation for its operator-centric approach. The firm boasts an extensive network of executives who have played pivotal roles in successful enterprises such as Salesforce, Workday, SAP, Oracle, ADP, Ceridian, and Cornerstone OnDemand.

“Our continued thesis is to invest in companies transforming work by leveraging technology to make people’s working lives simpler, more gratifying, and ultimately more productive. We are thrilled to continue our journey in building the most specialized early-stage venture firm, investing at the intersection of technology and work.” – Jason Corsello, General Partner at Acadian Ventures

In response to questions about their funds, Corsello revealed that Acadian Ventures’ first fund was $12 million and the firm currently manages $60 million in assets under management. Corsello acknowledged the challenging fundraising environment due to the industry downturn, but expressed gratitude for being oversubscribed. Acadian Ventures’ strong performance with its first fund played a significant role in generating interest for Fund II.

The venture capital firm currently has a team of four dedicated professionals working towards their mission of supporting innovative work technologies.